Mortgage Resources

Mortgage Resources Center

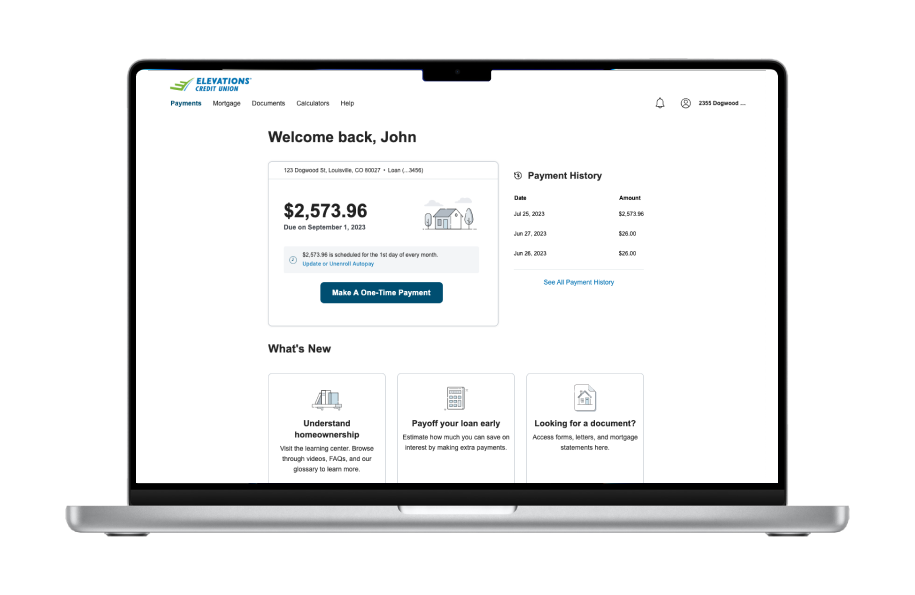

Our Mortgage Service Center will make managing your mortgage easier. Through our online center (also available on our mobile app), you can:

Set up one-time and automatic payments (if you are current on your loan)

Access your mortgage statements

Review your payment history

Request a payoff statement

Find a handy Amortization Calculator to see how additional payments can affect your loan balance

Switch to paperless statements

Find your year-end tax statements

Customize your text and email notifications

Access this resource through desktop and mobile app

Mortgage Payments

Mortgage payments are due on the first day of every month. Payments received after the 16th of the month will incur a late fee. Choose the way you’d like to make your payment:

OnlineFor payments from an Elevations accounts:

Click the "Pay" button on the Mortgage

Select the desired payment account from the "From Account" drop down

Select One-Time or Recurring and define processing date

For payments from an external account or to make additional principal payments:

Select “Mortgage Service Center” under the Accounts menu.

Click the "Make a Payment" button

To set up a recurring payment click the "Set Up Autopay" button

To set up a one-time payment, click the "Make a One-Time Payment" button

Follow the instructions to pay

Please note that if you set up recurring payments, your payment amount will automatically adjust if your mortgage payment changes for any reason.

By phone Choose to call our trusted mortgage servicing partner, Dovenmuehle Mortgage, Inc. (DMI), directly for faster processing times, or call us at Elevations.

How to call Dovenmuehle Mortgage, Inc.: Call (877) 849-9267(opens in a new window), Monday through Friday from 8 a.m.-5 p.m. MT. Have your routing number and account numbers for the electronic transfer ready. There is a fee of $9.50 for using the payment system or $11.50 for paying with a representative.

How to call Elevations: Call (800) 429-7626(opens in a new window) to make your mortgage payment, Monday through Friday from 7 a.m.-8 p.m. MT and Saturday from 8 a.m.-1 p.m. MT. Please note that your payment will take 1-3 business days to process.

At a branch or by mail

In branch: You can make a mortgage payment at any Elevations branch(opens in a new window).

By mail: Please mail a check with your name and 10-digit mortgage loan number (available on your mortgage statements) to:Dovenmuehle Mortgage, Inc.PO Box 660592Dallas, TX 75266-0592

Property Taxes

Each year, every county in Colorado collects taxes based on the assessed value of real property. This is generally referred to as a property tax or county tax. You should receive a Real Estate Property Tax Notice, sometimes referred to as a Tax Certificate, which are typically issued in January. Property taxes are paid in arrears, meaning taxes assessed for year 2018 are paid in 2019.

Please note: You will not need to provide us the Property Tax Notice and should retain it for your records.

The Property Tax notice should state: "If a mortgage company pays your taxes, do not pay this bill." A majority of mortgage borrowers pay each month into an escrow account from which property taxes are paid. If you are escrowing for property taxes, we will be responsible for paying them on your behalf. Our sub-servicer Dovenmuehle Mortgage Inc (DMI) handles all of our escrow account payments.

If you are not escrowing for property taxes, you are responsible for making the payment accordingly. It is imperative you pay these before the due date.

There are many ways to check if you are escrowing for Property Taxes. Your escrow information will show on your monthly billing statement or through your online banking mortgage service center. In the Mortgage tab, click “Mortgage Service Center” to be taken to Dovenmuehle Mortgage Inc.'s mortgage service center. You may also contact us directly for assistance.

If we are escrowing for your property taxes, our sub-servicer is responsible for updating how much is due for your property taxes, and then make disbursements. As designated on your Property Tax Notice, counties in Colorado allow for property taxes to be paid out in halves. As such, payments will be made in February and May each year to satisfy the amounts owed on your property taxes. You can see these amounts being disbursed on the appropriate monthly billing statement in the Transaction Activity box.

If we are escrowing for your property taxes, you have no additional responsibilities! Simply keep your Real Estate Property Tax Notice for your own records. If we are not escrowing for your property taxes, please ensure you make the payments as directed on the Property Tax Notice before the due date.

Property taxes can be listed on IRS Tax Form 1098, which lists required information about your mortgage loan. Property taxes may be listed on tax forms generated for the year in which they are made. As property taxes are paid in arrears, this means that taxes assessed for 2016 paid in 2017 will be listed on the tax year 2017 form. For questions related to taxes, please seek a qualified tax professional.

Homeowners Insurance & Flood Insurance

All loans require evidence of homeowners insurance. Homes within a flood zone also require evidence of flood insurance. There are minimum coverage requirements for both homeowners insurance and flood insurance. You are responsible for maintaining coverage on your home at all times during the life of the loan. Any lapse in coverage that occurs may have an insurance policy purchased at your expense.

If your Homeowners Association (HOA) provides a policy that covers your home, it is your responsibility to submit a copy of this policy to Dovenmuehle Mortgage Inc. (DMI) as evidence of insurance.

Yes! This is known as a mid-term change. When changing insurance carriers or coverages, you will be billed by your insurance company. You are responsible for making this payment – Elevations Credit Union will not make this payment. If you receive a refund, you may apply it towards your new policy. If escrowing, Elevations Credit Union will be responsible for making the payment upon the renewal of your policy. You will need to provide your new insurance carrier with our mortgagee clause below to ensure DMI receives declarations and billings. Mortgagee Clause: 1st Mortgage Only Elevations Credit Union ISAOA PO Box 961292 Fort Worth, TX 76161-0292 Reference your 10-digit loan number Should you have any further questions, or need to provide insurance information to DMI for processing, please contact them using the information listed below. Insurance Department Numbers Phone – (877) 849-9267 Fax – (855) 640-4865 Website – www.ihaveinsurance.com/mortgage(opens in a new window)Email - [email protected](opens in a new window)

Escrow Information

Many loan terms state that Elevations Credit Union will set up an escrow account to pay property taxes and insurance (including homeowners insurance and flood insurance) on your behalf. In most cases, if Elevations is escrowing for your loan, you will not need to make these payments. Our sub-servicer Dovenmuehle Mortgage Inc. (DMI) handles all escrow accounts.

Each year, counties in Colorado collect property taxes that are based on the assessed value of your home. Depending on the value of your home, taxes may increase or decrease. Insurance may also change each year depending on the value of the home and coverages purchased. This includes homeowners insurance and possibly flood insurance. Due to these changes, the amount required to be escrowed may increase or decrease. Each April, DMI completes a scheduled escrow analysis to ensure we are collecting appropriate funds. You will receive an Annual Escrow Account Disclosure Statement from DMI that details both a projection of payments for the coming year, as well as a history of the previous year’s payments. The escrow analysis will determine your new escrow payment, based on the updated information for property taxes and insurance. Download our Understanding Your Escrow Account Guide (PDF)(opens in a new window) for more information regarding escrow accounts, including how to read your Annual Escrow Account Disclosure Statement.

As described above, escrow payments may change. When you receive your Escrow Account Disclosure Statement, this will detail if there are any overages or shortages for your escrow account. Any overages over $50.00 will be paid directly to you in a check included with the statement. When a shortage has occurred, this means there were not enough funds collected to cover the payments disbursed throughout the year to pay the increased taxes and/or insurance. DMI will automatically spread your escrow shortage over a 12 month period, which will be added on top of your monthly mortgage payment. You may also choose to pay the entire shortage listed on the Escrow Shortage Remittance Form using one of the methods below:

Pay via online banking

Log into online banking(opens in a new window) using your digital banking username and password

Launch the mortgage service center by clicking on the mortgage name on the account dashboard

Select “Payment” and then “One Time Scheduled payment”

Use the right column payment option to enter the desired amount in the Escrow option

Mail a check with the remittance form directly to DMI

Upon receipt of the entire shortage payment, the monthly escrow shortage amount will be removed from your mortgage payment by DMI, which is reflected on the remittance form.

When you pay your shortage, you are covering the difference between the projected escrow disbursals and the actual escrow disbursals during the prior year. For example, if your Escrow Account Annual Disclosure Statement showed projected disbursals for property taxes of $1,000.00, but the actual required disbursal was $1,200.00, the difference is included as part of your shortage. This is found on page 2 of the Escrow Account Annual Disclosure Statement. However, the new projected escrow disbursal for property tax is now $1,200.00 for the coming year, rather than $1,000.00. Therefore, each month we must collect funds based on this new projection to ensure the escrow account can satisfy future payments when due. This means that though you paid your shortage, your monthly payment may still change to ensure your escrow account is adequately funded moving forward.

Each month we are required to collect one twelfth (1/12) of the total amount projected to be paid out from your escrow, along with a required cushion. While you can make an additional payment into your escrow account at any time, we still have to collect the required amount each month. In other words, extra funds paid to your escrow account will not change the amount we are required to collect from you each month. Any funds you pre-pay into your escrow account are used to calculate any overage or shortage during the annual escrow analysis. Any overages discovered during the annual escrow analysis must be returned to you accordingly.

There are many ways to check if you are escrowing. Your escrow information will show on your monthly billing statement or through your online banking mortgage service center. In the Mortgage tab, click “Mortgage Service Center” to be taken to Dovenmuehle Mortgage Inc.'s mortgage service center. You may also contact us directly for assistance.

Due to qualification requirements, please contact DMI for all requests to remove escrow on a loan. The customer service line is (877) 849-9267 for further assistance. This request must be made in writing and signed by all borrowers. Generally, loans must be 2 years seasoned prior to removal of escrow. Phone number: Customer Service – (303) 443-4672 or (800) 429-7626

Email: [email protected](opens in a new window)

Mailing Address: Attn: Mortgage Servicing 1 Environmental WayBroomfield, CO 80021

Make sure to reference your loan number with any correspondence.

First Mortgage Private Mortgage Insurance (PMI/MI)

Generally, Private Mortgage Insurance (PMI/MI) is required on your loan when the loan amount compared to the house value is over 80%. This is called your loan-to-value ratio. This insurance protects Elevations Credit Union in the case of default. Monthly payment of PMI is handled out of your escrow account by our sub-servicer, Dovenmuehle Mortgage Inc (DMI).

Your PMI/MI disclosure statement received at closing will detail when your monthly PMI payment will auto-terminate. If you have a monthly PMI/MI payment, you may qualify to have this removed upon meeting required federal guidelines. The earliest date to request removal of PMI/MI will be determined based on the loan-to-value ratio, the seasoning (age) of your loan, property value by appraisal and payment history.

To remove PMI/MI, please contact our mortgage servicing team at (303) 443-4672 ext 1709 or (800) 429-7626, or email [email protected](opens in a new window).

Insurance Claims

Should you experience damage to your home, we want to assist you with your insurance claim. Elevations and our servicing partner, Dovenmuehle Mortgage Inc. (DMI) must be notified of any damage sustained to your home. Should this happen, please contact us as soon as possible by calling us at (800) 429-7626 or visiting a branch.

Please bring the check along with the Insurance Adjustor’s Report and Contractor’s Estimate (if available) to any branch. The check must be endorsed by all borrowers listed as a payee on the check.

If the total amount of the actual cash value or total loss proceeds of your claim is less than or equal to $40,000, an Elevations staff member will review the Insurance Adjustor’s Report and your account. Once that process is complete and approved, an Elevations staff member can endorse the check and return it to you or deposit into your account. If the total amount of the actual cash value or total loss proceeds of your claim exceeds $40,000, or if your mortgage loan was delinquent at the time of loss, your claim will be processed by our servicing partner, DMI. Elevations will send the check and any documents you provided to DMI via FedEx.

Depending on the size of your claim, this process may take several weeks. Federal guidelines require certain steps to be taken ensuring the property is restored to its original or improved condition.

You should receive a letter from DMI that outlines the requirements for various claim amounts. Below is a summary of these requirements based on the Total Loss Proceeds (TLP). Total Loss Proceeds is the Actual Cash Value of the claim. The letter will also provide the name and phone number of the representative working on your claim.

For Total Loss Proceeds greater than $40,000

Check and claim documentation is sent to Dovenmuehle for processing. All insurance checks will be deposited into a restricted escrow account

Initial Disbursement

Initial disbursement will be the greater amount of either $40,000 or 33% of the Total Loss Proceeds, less a minimum of 10% holdback for progress inspection(s).

If the check is designated for contents and/or living expenses, DMI will immediately issue a check to you for those funds.

Subsequent Disbursement

Subsequent disbursements will be based upon the progression of repairs determined from periodic inspections.

Dovenmuehle will hold no less than 10% of the Total Loss Proceeds until final disbursement.

Progress inspection(s) will be required (at no cost to you) to ensure completion of work.

Final Disbursement

Final lien waiver may be required to release final funds disbursement and finalize claim.

Please note: All insurance claim submissions are subject to approval by Credit Union and/or Dovenmuehle. Release of funds timeframes are subject to change based on current status of first mortgage loan. Process can change based on current loan payoff amount.

Drop by a branch:

Take your documents into any Elevations branch, and we will send them to DMI on your behalf, or

Send to DMI:

If you would prefer to submit the documents directly to DMI, you must mail the Insurance claim check(s) to the following street address. The Insurance Adjustor’s Report and Contractor’s Estimate (if available) can be sent to DMI by Mail, Fax, or E-Mail. Be sure the check is endorsed by all borrowers listed as a payee on the check.

Mail: Dovenmuehle Mortgage Inc Attn: Loss Draft 1 Corporate Dr. Suite 360 Lake Zurich, IL 60047 Fax: (847) 574-7617

Email: [email protected](opens in a new window) Please be sure to write your 10-digit loan number on all documents.

Please contact DMI’s Loss Draft (Insurance Claim) department at (877) 592-0192. They will be able to provide a status update on your claim and answer any questions that you have. If you have other questions or concerns, please contact our mortgage servicing team at (303) 443-4672 ext 1709 or visit a branch.

Contact Dovenmuehle

Dovenmuehle (DMI) is an Elevations Trusted Servicing Partner.

Phone number Customer Service – (877) 849-9267(opens in a new window) Property Damage/Loss Draft – (877) 592-0192(opens in a new window) (phone) Property Damage/Loss Draft – (847) 574-7617 (fax)Loss Mitigation - (866) 397-5370(opens in a new window) (phone) Mailing Address: Elevations Credit Union 1 Corporate Dr Ste 360 Lake Zurich, IL 60047 Make sure to reference your 10-digit loan number with any correspondence.